By Joel Chouinard, ChFC®

November 6th, 2025

If you're on track to make partner at a Big Law firm, you're probably focused on the increased earning potential and new responsibilities. But there's a financial reality that catches most new partners off guard: despite making more money, many partners take home less in their first year than they did as senior associates.

I recently analyzed this for a client who had just made the transition, and we found that after everything was said and done, she would take home 15% less income than she had as a senior associate.

The culprit? The moment you make partner, you shift from employee to business owner, and the tax code treats these two classifications completely differently.

This guide breaks down the specific tax changes that create this counterintuitive outcome and why understanding them now—before you make partner—is critical for your financial planning.

What's the Fundamental Tax Change When You Make Partner?

As an associate, your tax life is relatively straightforward. You receive a wage, taxes are withheld from your paycheck and sent to the IRS on your behalf, and at the end of the year, your firm sends you a W-2. You hand that to your accountant, and if you overpaid your withholdings, you get a refund. If you underpaid, you owe taxes.

As a partner, everything changes. You're now considered self-employed—even though you're still part of a large firm with hundreds of attorneys and employees. From a tax perspective, you're a business owner, just like if you owned a coffee shop around the corner from your office.

This shift creates immediate changes to your tax obligations:

- No automatic withholdings: Taxes are no longer withheld from your paychecks. It's your job to remit them to the IRS.

- Quarterly estimated payments: You're responsible for calculating what you owe and sending payments directly to the IRS four times per year.

- K-1 reporting: All of your income is reported on a K-1 (not a W-2), which significantly increases the complexity and cost of tax preparation.

- Self-employment tax: You now pay both the employee and employer portions of Social Security and Medicare taxes.

- Multi-state filing requirements: You owe taxes in every state where your firm earns a profit, not just where you live.

The cash hitting your bank account no longer represents your actual take-home pay. A significant portion belongs to the IRS, and it's your job to set it aside and remit it on time.

How Do Quarterly Estimated Tax Payments Work?

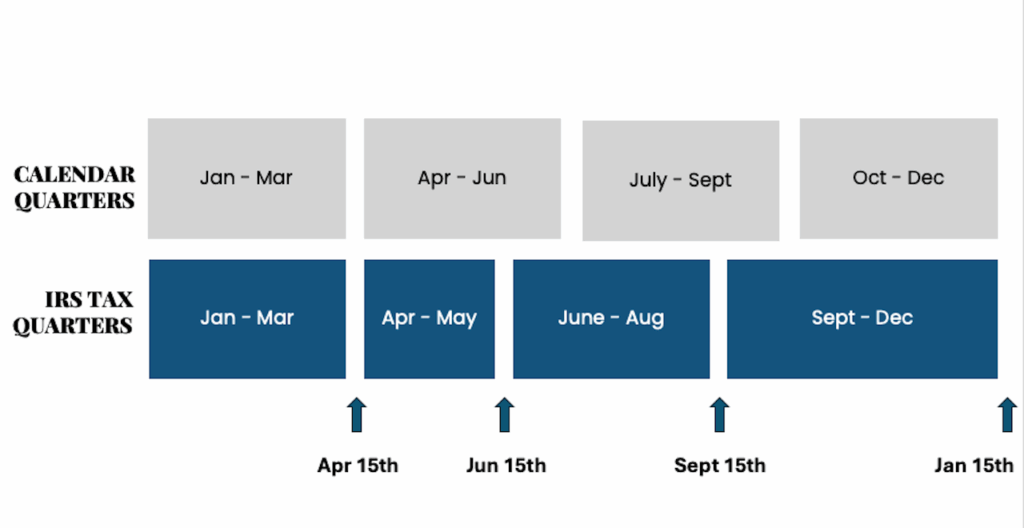

The IRS requires you to pay taxes as you earn income throughout the year through quarterly estimated tax payments. These payments are due on four specific deadlines (see graphic below). Here's where it gets unnecessarily complicated: IRS quarters don't align with calendar quarters.

The IRS quarter structure:

- Q1: January-March (3 months) → Payment due April 15

- Q2: April-May (2 months) → Payment due June 15

- Q3: June-August (3 months) → Payment due September 15

- Q4: September-December (4 months) → Payment due January 15

Notice that Q2 covers only two months while Q4 covers four months. This creates significant cash flow challenges for Big Law partners, whose income is typically concentrated in Q4 with large year-end distributions and bonuses.

These are called "estimated" payments because you're making your best guess about what you'll earn for the entire year. If you underestimate and don't pay enough by each quarterly deadline, the IRS assesses underpayment penalties plus interest—even if you eventually pay every dollar you owe.

The penalty structure assumes you earn income evenly throughout the year. So if you earn most of your income in Q4 (which most Big Law partners do), but haven't made sufficient payments in Q1-Q3, you'll face penalties for those earlier quarters.

This is why working with a CPA who understands Big Law partner income patterns is essential.

What Is Self-Employment Tax?

When you're an associate in Big Law, you pay Social Security and Medicare taxes—but you actually split the bill with your firm. You pay half (7.65%) and they pay half (7.65%), for a total of 15.3%.

As a partner, you're both the employee and the employer, so you pay both sides—the full 15.3%. This is called the self-employment tax.

How much is the Self-Employment Tax?

For 2026, only the first $184,500 of your income is subject to the Social Security portion (12.4%), which means you'll pay approximately $23,000 in Social Security tax regardless of whether you make $300,000 or $3 million.

The Medicare portion (2.9%) applies to your entire partnership income with no cap. So if you earn $500,000, you're paying $14,500 in Medicare tax. If you earn $1 million, you're paying $29,000.

Also, half of your self-employment tax is deductible on your personal tax return, which provides some relief. But when you run the numbers, a new Big Law partner can easily pay $15,000-$20,000 more per year in self-employment tax compared to what they paid as a senior associate.

This is a major contributor to the "I'm making more but taking home less" phenomenon.

Do Big Law Partners Have to File Taxes in Multiple States?

Here's another surprise: you're now responsible for paying taxes in every state where your firm operates and generates income—not just the state where you live and work.

As a partner, you own a share of the business, which means you own a share of the income generated in each state where your firm has offices. And states want their cut of that income.

Even if you live in Texas or Florida (states with no income tax), you'll still owe state income tax on your proportionate share of income generated in New York, California, Illinois, and every other state where your firm operates.

The composite return solution:

Most Big Law firms offer composite returns, where the firm files a single return on behalf of all partners in each state and withholds the appropriate amounts from your distributions. This dramatically simplifies the filing burden.

However, New York requires partners to file individual returns, which adds to both cost and complexity.

Multi-state filing significantly increases CPA fees. While a straightforward W-2 return might cost $500-$1,000, a partnership K-1 with multi-state obligations can easily run $2,500-$5,000 or more.

Please email me (joel@sharpedgefinancial.com) if you want a list of vetted CPAs who specialize in working with Big Law attorneys.

What's the Real Cash Flow Challenge?

Here's the fundamental shift that trips up new partners: the money hitting your bank account is no longer yours to spend.

As an associate, your paycheck represents your actual take-home pay. Taxes have already been withheld. What you see is what you keep.

As a partner, every distribution or draw that hits your account includes money that belongs to the IRS. But it's not labeled differently—it all looks the same in your checking account.

The timing mismatch problem:

The cash flow challenge is compounded by a significant mismatch between when you receive income and when you owe taxes.

Most Big Law partners receive income in a heavily back-loaded pattern: regular draws in Q1-Q3, then in Q4 you receive regular draws PLUS a large quarterly profit distribution PLUS potentially a year-end bonus. It's not uncommon for partners to receive 50% or more of their annual income in Q4 alone.

But the IRS doesn't care about your income distribution pattern. They assume you earn income evenly throughout the year and require equal quarterly payments.

A cash flow example:

Let's say a new partner has a projected annual tax liability of $100,000, with their accountant recommending four equal quarterly payments of $25,000.

In Q2 (which is only two months), they would owe 25% of their tax liability but only receive about 15% of their annual income. By Q4, when they finally receive the bulk of their income, they've already made three-fourths of their tax payments.

This mismatch creates cash flow crunches in the first three quarters of the year. New partners who haven't built up cash reserves or implemented systematic savings approaches find themselves overspending early in the year, then scrambling when quarterly payment deadlines arrive.

This is why so many new partners feel financially stressed despite making significantly more money on paper.

How Can You Avoid IRS Underpayment Penalties?

Falling behind on quarterly estimated tax payments triggers IRS penalties that can climb into thousands of dollars each year for high-earning Big Law partners.

The IRS assumes you earn income evenly throughout the year. If you haven't paid enough by each quarterly deadline, you face underpayment penalties plus accruing interest—even if you eventually pay everything you owe.

Two strategies protect against penalties:

1. The Safe Harbor Provision: If you pay 110% of your previous year's total tax liability across your four quarterly payments, you're protected from underpayment penalties regardless of how much you actually earn in the current year.

2. The Annualized Installment Method: This IRS form allows you to prove you couldn't have paid more in earlier quarters because you hadn't earned the income yet. It recalculates required quarterly payments based on when you actually received income rather than assuming even distribution.

Your CPA should be implementing these strategies as part of your tax planning. If they're not discussing safe harbor requirements and the annualized installment method, that's a red flag they may not have experience with Big Law partner income patterns.

Why Understanding These Changes Matters

The minute you make partner, your financial life becomes exponentially more complex. You're not just dealing with higher income—you're managing quarterly estimated tax payments, self-employment tax calculations, multi-state filings, variable cash flow, and penalty avoidance strategies.

And this is all happening while you're adjusting to new responsibilities at the firm, longer hours, and increased client development expectations.

Many new partners try to handle this complexity alone or with generalist CPAs who don't specialize in Big Law partner finances. This typically results in one or more of the following:

- Underpayment penalties from incorrect quarterly estimates

- Cash flow crises when payment deadlines arrive

- Overpaying taxes due to inefficient withholding strategies

- Unnecessarily high tax preparation costs from multiple CPA changes

- Constant financial stress despite higher income

What successful partners do differently:

The attorneys who navigate this transition successfully recognize early that partner taxation and cash flow management require specialized expertise and systematic approaches.

They work with CPAs who understand Big Law partner income patterns, safe harbor requirements, and multi-state filing complexities. But that's only one side of the story. You also need to implement cash flow systems so that you have enough to make your tax payment when they are due, but also continue to save for your future. This is where the help of a financial planner who specializes in working with Big Law partners comes in. They can help integrate tax planning with the rest of your financial plan.

What's Next: Understanding Benefits Changes Ahead of Making Partner

This article covered the tax transformation that happens when you make partner and why so many new partners feel broke despite higher income. The next critical piece is understanding how your benefits change—including retirement plans and health benefits that are no longer subsidized by your firm.

These changes create additional planning considerations that, combined with the tax complexity covered here, require careful coordination to manage effectively.

Need Help Making a Plan?

If you're approaching partnership and want guidance on navigating both the compensation changes and tax implications, these transitions benefit from professional coordination.

Working with an advisor who specializes in Big Law attorney finances can help you develop strategies that account for your unique circumstances—so you can focus on your career and life rather than becoming an expert in partner taxation and financial planning.

👉 Schedule your free introductory call

👉 Learn more about our services & pricing

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.