By Joel Chouinard, ChFC®

March 7, 2024

Maybe it’s because I’m a financial planner, but I feel like my social media feed is filled with posts promoting new “ground-breaking” ways to invest money that will somehow allow you to retire in 5 years and set off in the sunset on your yacht. The idea of setting off in the sunset on a yacht sounds amazing, don’t get me wrong, but I just don’t buy into the idea that there’s a shortcut around building wealth. Saving consistently every month and every year will have a much bigger impact on your financial situation than getting an extra percentage return on your investment. Skeptical? Just read below. But first, let’s establish what a rate of return and savings rate actually mean.

What Is a Rate of Return?

A rate of return (ROR) is like a gauge that helps you determine if your investment is doing well or not, shown as a percentage increase or decrease. In other words, it's the measure of how much money you've made or lost on an investment compared to the original amount you put in. In personal finance, since investments are held for many years, we often use the average annualized ROR to compare investments performance over time.

What Is a Savings Rate?

A savings rate is the portion of your income that you choose to save rather than spend, illustrated as a percentage. For example, if you make $100K/year and you save $20,000, your savings rate is 20%. The savings rate is often used in personal finance to determine whether someone is on track to meet their financial goals. It can also be used as a target to motivate people to increase their savings.

Which Matters More, Rate or Return or Savings Rate?

I’m a very practical person, so when I need to understand a concept or evaluate two alternatives, I prefer using a real-life hypothetical example rather than a theoretical analysis. Meet the two hypothetical couples*.

Johnny and Gina Spenders

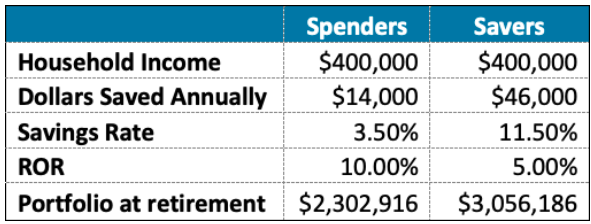

Johnny and Gina are both in their mid-thirties with 30 years left until retirement. They make a really good household income of $400K, but they are big spenders and don’t save much outside of maximizing their respective IRAs (total of $14K/year).

Even though Johnny is a not a great saver, he is a savvy investor, and he’s been averaging a 10% year-over-year ROR on their portfolio.

Jacob and Sophia Savers

Jacob and Sophia are also both in their mid-thirties with 30 years left until retirement. They make the same household income as the Spenders, but they are excellent savers and both max out their 401(k)s each year (total of $46K).

Jacob and Sophia aren’t savvy investors and are uncomfortable with the fluctuation in their accounts, so they opted for a simpler, more conservative approach for their portfolio. They both invest their 401(k)s in a conservative mutual fund that averages a 5% year-over-year ROR.

Results: Which couple is better off in retirement?

As you can see with the chart below, the Savers have over $750K more than the Spenders at retirement, even though they had a ROR that was half of the Spenders. Imagine the Savers had invested in a mutual fund that better fit their time horizon and averaged a rate of return of 7% instead of 5%. That would have grown their portfolio to over $4.3M at retirement!

Final Note

The bottom line is if you focus your energy on increasing your savings rate, rather than your rate of return, you may be better off in the end. Make sure you are invested in a high quality portfolio that is matched to your risk profile and time horizon, and let compounding growth do its thing!

*This is a hypothetical scenario and is for illustrative purposes only. The Spenders and Savers are not real clients of SharpEdge Financial. In real life, rate of returns are not fixed and not guaranteed.

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.