By Joel Chouinard, CHFC®

December 18th, 2025

I get this question frequently from newly promoted Big Law partners: "Why do I feel broke? I just got the biggest promotion of my life."

The answer lies in how the IRS now sees you. You're no longer considered an employee—you're a self-employed individual, just like if you owned a coffee shop around the corner from your office. That classification has significant implications for your compensation, taxes, benefits, and cash flow.

Let me show you exactly what changes and what you can do about it.

Why Do New Big Law Partners Feel Broke?

There are five main factors that create this counterintuitive cash flow reality:

1. Quarterly Estimated Tax Payments

As an associate, taxes were withheld from your paycheck and remitted to the IRS on your behalf. As a partner, taxes are no longer withheld, and it's your responsibility to remit your taxes to the IRS each quarter.

That means you must set aside a portion of each paycheck for later payment to the IRS. The money hitting your account isn't actually all yours—a significant chunk belongs to the IRS.

2. Self-Employment Tax

As an associate, you pay half of the Social Security and Medicare tax, and the firm picks up the other half. As a self-employed individual (which is how partners are classified), you're technically the business owner, so you pay both the employee and employer side of the Social Security and Medicare tax.

This is called the self-employment tax, and it raises your overall tax liability by thousands of dollars annually.

3. Multi-State Tax Filing

Because you're an owner of the firm, you share in the profits of the firm in all the states where the firm operates. That means you have to pay your share of the tax liability in those states—even states where you don't live or work.

You'll be filing taxes in multiple different states, which not only increases your tax burden but also significantly increases your tax preparation fees.

If you want to learn more about how partners are taxed, I wrote a comprehensive blog post on the topic. You can read it here.

4. Unsubsidized Benefits

As a partner, now that you're an owner of the firm, your benefits are no longer subsidized. Think about it—you'd be subsidizing your own benefits, which wouldn't make sense. The subsidies would be deducted from your profit distributions.

That means your benefits premiums can jump from a small percentage of your income to $2,000-$3,000 per month for a family.

5. Mandatory Retirement Contributions

As a result of becoming a partner, you'll be subject to mandatory profit-sharing and cash balance plan contributions. Income partners may only have to do the profit-sharing portion, but once you become an equity partner, you'll more likely be required to contribute to the cash balance plan as well.

Between the two, you can expect an additional $60,000 to $70,000 per year that you must contribute to those retirement accounts.

Now, it's not like that money is lost forever—you'll see it back one day in retirement. But for a 35 or 40-year-old partner, that's a long time, and it impacts your cash flow today.

If you want a complete guide on how your benefits will change as a partner, I wrote a comprehensive blog post on the topic. You can read it here.

What's the Real Financial Impact of Making Partner?

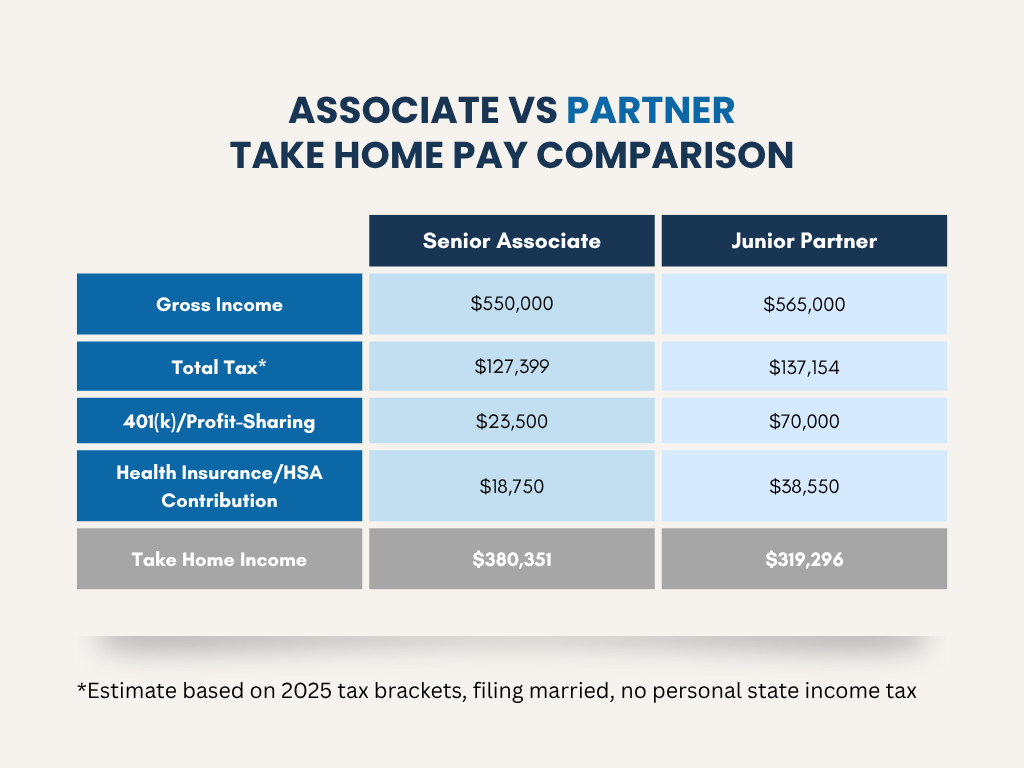

To show you how these changes affect your take-home pay, I put together a comparison between a senior associate's and a junior partner's take-home pay when you factor in all of these changes.

As you can see, the difference is about $60,000 less in your pocket as a junior partner than as a senior associate—even after getting a $15,000 raise as a result of the promotion.

No wonder some partners feel broke after transitioning to partner.

But there are strategies you can implement to mitigate this impact. Let me walk you through three critical ones.

Strategy #1: Hire a Qualified Tax Professional

As an associate in Big Law, your taxes are relatively simple, and you can probably get away with using TurboTax. As a partner, your taxes become significantly more complex, and you must work with a qualified tax professional.

What to Look for in a Tax Professional

The key is finding a tax professional who does both tax preparation AND tax planning. Here's the difference:

Tax Preparation is gathering your documents and filing your tax return on your behalf. You're looking in the rearview mirror—reviewing what happened in the past year and dealing with it.

Tax Planning is taking a proactive approach and making changes before the end of the tax year.

For example, if you're in Q4 and you do a tax projection, you may realize you're going to be short with your tax payments for the year. You can make an estimated payment in Q4 to minimize your tax penalties. That's a short-term benefit of tax planning.

Tax planning also provides long-term benefits. For instance, the recommendation to do a backdoor Roth IRA for a Big Law attorney could have over $100,000 in tax benefits over your lifetime by simply shifting your assets from one bucket to another.

What Does a Good Tax Professional Cost?

A qualified tax professional will cost more than TurboTax. You can expect to pay between $2,500 and $5,000 per return, depending on where you live and the complexity of your return. If you have a spouse who is also a business owner, that may increase the cost.

If you're lucky enough to work with both a good CPA and a financial planner who understands your cash flow, that's the ideal situation. Your financial planner will have a deep understanding of your goals and cash flow and can coordinate with your CPA on recommendations to reduce taxes now and later.

A good example would be making a charitable contribution before year-end to reduce your tax burden. Another benefit is that your financial planner typically has most of the tax documents you'll need to prepare your return and can send those to your CPA, saving you valuable time.

A good tax professional will cost more, but it's worth every penny—especially considering that you could pay thousands of dollars in underpayment penalties if you mess up your taxes.

If you need a list of vetted accountants who specialize in working with Big Law attorneys, reach out to me at joel@sharpedgefinancial.com.

Strategy #2: Create a Savings Account Earmarked for Taxes

When you're a Big Law partner, it's one thing to know your tax liability each quarter. It's another thing to actually have the cash on hand to make those quarterly payments.

Remember, as a partner, your taxes are no longer withheld from your paycheck, so it's your responsibility to remit them to the IRS each quarter. That means some of the money you receive from your draws, distributions, and bonus is not all yours—a good chunk belongs to the IRS.

How to Set Up a Savings System for Your Quarterly Estimated Payments

Here's what I typically recommend:

Work with your accountant to determine a set percentage or dollar amount that you'll send to a tax savings account each time you get paid. If it's 35% or 40%, send that automatically to your tax savings account. For example, if your draw is $20,000/month and your accountant recommended sending 40% of your paychecks, set up an automatic transfer of $8,000/month.

Automate the process so you don't forget or end up spending too much money and not having funds to transfer. When payments are due, you just pay straight out of that tax savings account. Money out of sight, out of mind—just like withholdings on your paychecks as an associate.

The Q2 Cash Flow Crunch

Even with a tax savings account, you'll face one big issue that typically comes up around the second quarter (April and May). In Q2, you only get about 15% of your annual income—just two months' worth of draws and distributions.

But most accountants will recommend that you make four equal payments throughout the year for your tax liability—that's 25% of your tax liability each payment.

You can see the discrepancy: you receive 15% of your income but have to pay 25% of your tax liability. This usually creates a cash flow crunch.

The Solution: Pre-Fund Your Tax Account

The way around this is to pre-fund your tax savings account at the beginning of the year with at least one quarter's worth of taxes. That way, you're always ahead.

For Big Law attorneys, since you get a substantial bonus at the end of the year, you can use your bonus to pre-fund that tax account.

I also recommend using a high-yield savings account for your tax account. You might as well earn some interest while that money's sitting there.

Strategy #3: Review Your Personal Cash Flow

This last strategy isn't really a strategy per se, but it's something I recommend every new Big Law partner go through before the transition: reviewing your personal cash flow.

If I told you you'd be taking home 15% less income as a junior partner than as a senior associate, you probably wouldn't believe me. But unfortunately, that's the case for many Big Law attorneys making the transition.

That's why it's crucial to have a clear understanding of your personal cash flow.

How to Map Out Your Cash Flow

The best way to do this is through a conscious spending plan. Here are the five steps:

Step 1: Start with your gross monthly income. Only include guaranteed pay, like your draws. You can also include minimum distributions you can expect or minimum bonus, but don't include anything you're not confident you'll receive.

Step 2: Determine your tax liability and benefits cost. Work with your accountant or financial planner to calculate these accurately. This gives you your true net take-home pay.

Step 3: Deduct your savings needed for the year. I typically recommend saving about 20% of your gross income. If you make $500,000 a year, that's $100,000 you'd need to save annually.

A hundred thousand dollars might sound like a lot, but don't forget that you have the mandatory profit-sharing contribution (around $46,500), potential mandatory cash balance plan contributions ($20,000-$30,000 as an equity partner), plus your employee 401(k), HSA, and Roth IRA. It can reach $100,000 pretty quickly.

Step 4: Calculate your fixed expenses. These are things that don't change much from month to month—your mortgage, utilities, car payments, daycare, tuition payments, etc.

Step 5: What's left is your guilt-free spending. This is money you can spend without guilt on whatever you want.

For a complete guide on how to map out your cash flow, check out this blog post.

What If You Have a Deficit?

Going through your conscious spending plan will show you whether you have a surplus or a deficit based on your new compensation structure.

If there's a surplus, you can spend a little more in that guilt-free bucket or save even more. If there's a deficit, you'll need to look at your fixed expenses and guilt-free spending to see where you can cut back—a deficit isn't sustainable long-term.

What Can You Do During the Adjustment Period?

I know this may sound demoralizing for new partners, but your income trajectory as a Big Law partner will far outpace this initial setback in your first couple of years.

As you adjust to this new reality, there are two things you can do:

1. Temporarily Cut Back on Savings

There will be mandatory profit-sharing contributions and potentially cash balance plan requirements, so you're already saving a substantial amount. It's okay to temporarily reduce some of the other savings you were doing—maybe to a brokerage account, Roth IRA, or even the employee component of the 401(k) that's not mandatory.

Don't get used to it long-term, though. You still want to save 20% of your income overall. But a temporary adjustment while you get your footing is reasonable.

2. Cut Back on Discretionary Spending

Maybe you don't take that big trip you normally take every year, or you spend a little less on shopping for that year—just as you get accustomed to your new income structure.

Your income trajectory will quickly outpace this little setback, so you'll be able to return to those spending habits you had before.

Need Help Navigating the Transition?

The transition to partnership brings significant financial complexity that extends beyond what most attorneys anticipate. The interplay between tax planning, cash flow management, mandatory retirement contributions, and long-term wealth building requires careful coordination.

Working with an advisor who specializes in Big Law attorney finances can help you develop strategies that account for your unique circumstances—so you can focus on your career and life rather than becoming an expert in partner taxation and financial planning.

If you're approaching this transition and want guidance on navigating these changes, these transitions benefit from professional coordination.

👉 Schedule your free introductory call

👉 Learn more about our services & pricing

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.