By Joel Chouinard, CFP®

November 20th, 2025

If you're on track to make partner at your Big Law firm, you may be focused on understanding the compensation changes and tax implications. But there's one more major shift that impacts your take-home pay: your benefits are no longer subsidized by the firm.

As an associate, you pay a portion of your benefits premiums while the firm covers the rest—typically a 20%-80% split. As a partner, you pay 100% of the cost. Think about it, it wouldn't make sense for the firm to subsidize benefits for the people who own the firm. You'd be dipping into your profitability to subsidize your own benefits.

The result? Partners can take home $20,000 to $30,000 less than they did as senior associates, just because of benefits. And that's not counting mandatory profit-sharing contributions!

This guide breaks down the specific benefits changes that happen when you make partner and why careful planning before the transition is essential, so you can prepare for the cash flow impact rather than being caught off guard.

Note: If you are an income partner and are still considered a W2 employee, this article likely won't apply to you until you make equity partner. But feel free to read along anyway!

Why Are Partner Benefits No Longer Subsidized?

The fundamental shift from employee to business owner drives this change. As an associate, you're an employee of the firm, and like most employers, the firm subsidizes a significant portion of your healthcare and other benefits. As a partner, any subsidies would come out of your profit distributions or draws anyway—you'd essentially be subsidizing your own benefits. So most firms eliminate the subsidy structure entirely for partners.

The income partner situation:

Income partners face a particularly challenging scenario. They don't yet share in the firm's profits, but they also lose the benefits subsidy. They get the cost burden of ownership without the profit upside. Some firms, like Kirkland & Ellis, have recognized this inequity and created special stipends for new partners to help offset the higher premiums during the income partner phase.

What Do Partner Benefits Actually Cost?

If you have a family with children, expect your benefits premiums to run $2,000-$3,000 per month. That's $24,000-$36,000 annually for healthcare coverage.

For individual coverage or coverage for you and a spouse, costs will be somewhat lower, but still substantially higher than what you paid as an associate.

This represents a $10,000-$20,000 annual increase in benefits costs for most new partners compared to their senior associate years.

What Benefits Do You Lose as a Partner?

Beyond losing the subsidy, you also lose access to certain pre-tax benefit vehicles that were available to you as an associate:

Healthcare and Limited Purpose Flexible Spending Accounts (FSAs): These pre-tax accounts, which allowed you to set aside money for medical expenses are no longer available. You can still use a Health Savings Account (HSA) if you're on a high-deductible health plan, but FSAs are off the table.

Dependent Care FSAs: The pre-tax dependent care accounts you may have used for childcare expenses are no longer available. You can still take the dependent care tax credit on your personal tax return, but you lose the ability to make pre-tax contributions.

Commuter Benefits: Pre-tax parking and transit benefits typically disappear when you make partner, although you can typically deduct them as business expenses on your tax return.

What Benefits Do You Keep?

You'll maintain access to important coverage like long-term disability insurance and group life insurance through the firm.

Additionally, many firms either require or strongly encourage partners to carry umbrella insurance. Some firms pay for this coverage, while others make it mandatory for partners to purchase on their own. Check with your HR team to understand your firm's specific policy.

Umbrella insurance becomes increasingly important as your income and assets grow, providing liability protection beyond your standard policies.

Are Partner Benefits Tax Deductible?

Yes, but the mechanics work differently than they did as an associate.

As an associate, many of your benefits came out pre-tax through payroll deductions. As a partner, you're no longer receiving a traditional paycheck with withholdings—you're receiving draws.

Your benefits premiums will come out of your draws, but they won't be pre-tax at that point. Instead, you'll deduct them on your personal tax return when you file the following year using Schedule 1, where you'll include health insurance premiums, HSA contributions, 401(k) contributions, and other deductions.

Additional deductions for business owners:

As a partner, you're now classified as a business owner, which opens up additional deductions that weren't available to you as an associate:

- Cell phone expenses

- Unreimbursed business travel

- Other business-related expenses

These deductions also go on your personal tax return.

Important exception for W-2 income partners:

If your firm treats income partners as W-2 employees (a structure some firms have adopted), then nothing changes from your senior associate structure. Benefits may still be subsidized, you'll continue with paycheck withholdings and pre-tax contributions, and only your title changes. This is firm-specific, so verify your classification.

What New Retirement Opportunities Do You Gain?

While the benefits news seems largely negative, there is a significant upside: you now have access to retirement plans that are only available to business owners.

Profit-Sharing Plans

Most Big Law firms attach profit-sharing plans to their existing 401(k) structure. Here's how this works:

A 401(k) has two contribution buckets:

- Employee contributions: The $23,500 you contribute (2025 limit)

- Employer contributions: What the firm contributes on your behalf

As a partner, you're both the employee and the employer, which means you get to contribute to both sides of the plan.

The total 401(k) contribution limit in 2025 is $70,000. If you're maxing out the employee side at $23,500, that leaves $46,500 available for profit-sharing contributions.

How profit-sharing contributions work:

Most firms make these contributions mandatory for partners, though some (like Kirkland & Ellis) allow new partners to step into the requirement gradually (e.g., 25% of the limit in year one, 50% in year two, and the full amount in year three).

These contributions typically come out of your quarterly profit distributions if you're an equity partner, or from your year-end bonus. Employee contributions still come from your regular draws.

Bottom line: you need to budget for an additional $46,500 in mandatory retirement contributions. You'll see this money again in retirement, and you'll get some tax relief in the current year, but it's still a significant chunk that needs to come from somewhere in your cash flow.

Cash Balance Pension Plans

Some Big Law firms also maintain cash balance pension plans. These are technically pension plans but function more like 401(k)s in practice.

How they work:

You contribute money to the plan, that money grows over time, and you can take it out in retirement either as a lump sum or as an income stream for life.

The key differences from a 401(k):

- Contributions are mandatory each year

- You don't have an individual account—all partner money is pooled together and you have an allocated share of the total pool

Two components determine your contribution:

Pay Credit: A predetermined amount based on your income and age. The older you are and the more you earn, the more you're required to contribute.

For example, a 40-year-old partner earning $750,000 might be required to contribute $45,000 annually, while a 60-year-old partner earning $2 million might be required to contribute $150,000 annually.

Interest Credit: This is essentially your rate of return, usually with both a floor and a ceiling. If the pooled investments earn 10% in a given year, you might be capped at 7% credit (with the excess reserved for down years). If investments lose 5%, you might have a floor of 1%.

What happens if you leave before retirement:

You can roll your cash balance into an IRA or into your new firm's 401(k) plan.

What's the Actual Cash Flow Impact?

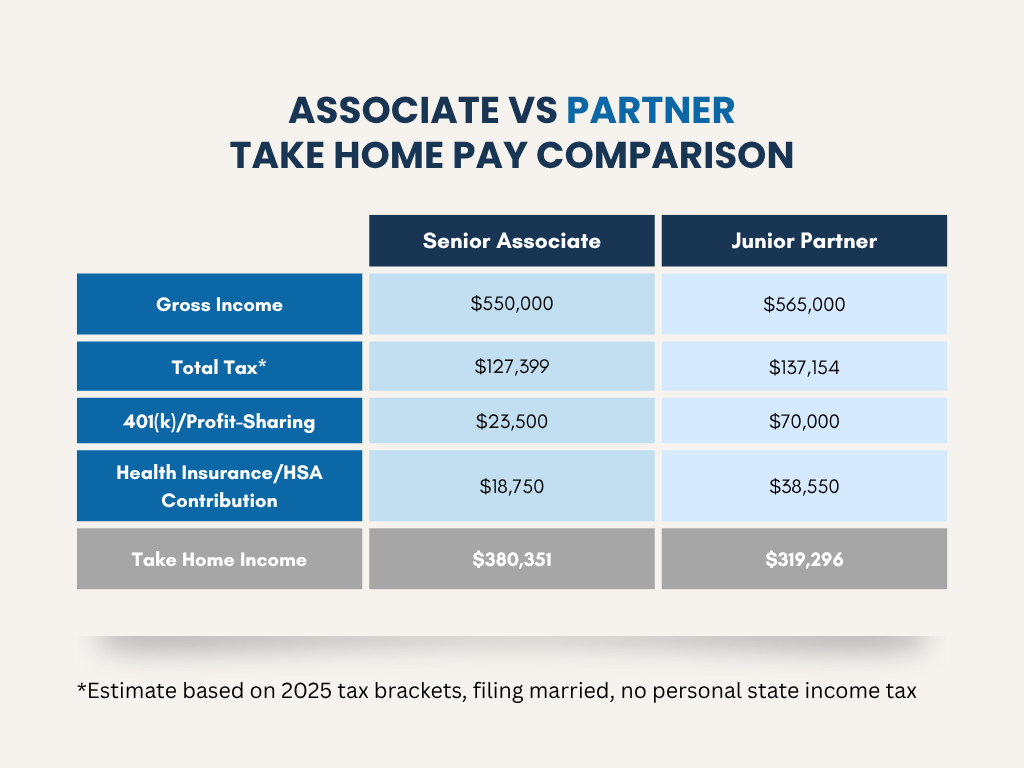

A few months ago, I built a cash flow projection for a client making the transition to partner this year. After factoring in taxes, higher benefits costs, and mandatory retirement contributions, here's what we found:

Senior Associate Take-Home: $380,000

Junior Partner Take-Home: $319,000

Difference: ~$61,000

Despite a modest increase in compensation ($15,000), she would take home $60,000 less as a junior partner than she did as a senior associate.

Here's the breakdown of where that money goes:

Increased taxes: The shift to self-employment taxation, including self-employment tax and multi-state filing obligations, increases the overall tax burden.

Mandatory retirement contributions: The jump from $23,500 (401(k) only) to $70,000 (401(k) plus profit-sharing) represents an additional $46,500 that must come out of current cash flow.

Benefits cost increase: The elimination of subsidies and loss of pre-tax benefit options increases annual benefits costs by approximately $15,000-$20,000.

This is why so many new partners feel "broke" in their first couple years despite technically making more money.

Why This Isn't All Bad News

While taking home less money initially seems discouraging, there are important factors to consider:

Your income trajectory will accelerate: As you move from income partner to equity partner and progress in the partnership structure, your compensation will quickly outpace this initial setback.

Forced retirement savings benefit your future self: While it's painful to see $70,000+ going to retirement accounts each year, you're building substantial wealth that will compound over decades. Many attorneys wish they'd been forced to save this aggressively earlier in their careers.

You're building toward equity ownership: If you're on the income partner track, you're positioning yourself to eventually share in firm profits, which will far exceed the temporary cash flow reduction.

Tax deductions provide some relief: While you're paying more for benefits, the ability to deduct these costs plus additional business expenses provides meaningful tax savings.

What's Next: Strategies to Mitigate the Cash Flow Impact

This article covered the specific benefits changes that happen when you make partner and their impact on your take-home pay. The next critical piece is understanding strategies to mitigate this cash flow impact so you're not caught off guard.

These strategies involve advanced planning and coordination between your compensation structure, tax planning, and overall financial strategy.

Need Help Making a Plan?

If you're approaching partnership and want guidance on navigating compensation changes, tax implications, and new partner benefits, these transitions benefit from professional coordination.

Working with an advisor who specializes in Big Law attorney finances can help you develop strategies that account for your unique circumstances—so you can focus on your career and life rather than becoming an expert in partner taxation and financial planning.

👉 Schedule your free introductory call

👉 Learn more about our services & pricing

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.