By Joel Chouinard, ChFC®

October 2nd, 2025

Open enrollment season is here, and if you're a millennial or Gen Z attorney, the benefits choice you make in the next few weeks could impact your lifetime wealth by over $1 million.

The decision between copay plans and high-deductible HSA plans extends far beyond this year's medical expenses. Yet, most attorneys I work with focus only on the immediate costs, missing the massive long-term wealth-building opportunity.

The Stakes: Why This Decision Matters More for Attorneys

As someone who's married to a former big law attorney and has educated hundreds of attorneys on personal finance, I see the same pattern repeatedly. High-earning legal professionals get sophisticated investment advice but overlook one of the most powerful tax-advantaged wealth-building tools available: the Health Savings Account.

The math is compelling when executed correctly. A 35-year-old attorney who maximizes HSA contributions over 30 years could build a $1.36 million tax-free retirement account - with over $1 million in growth the IRS can never touch*. But this requires a coordinated approach with your overall financial strategy to maximize the benefits.

*Assuming HSA contribution limits grow at a 2.45% annual rate and funds inside the HSA grow at 8% annually.

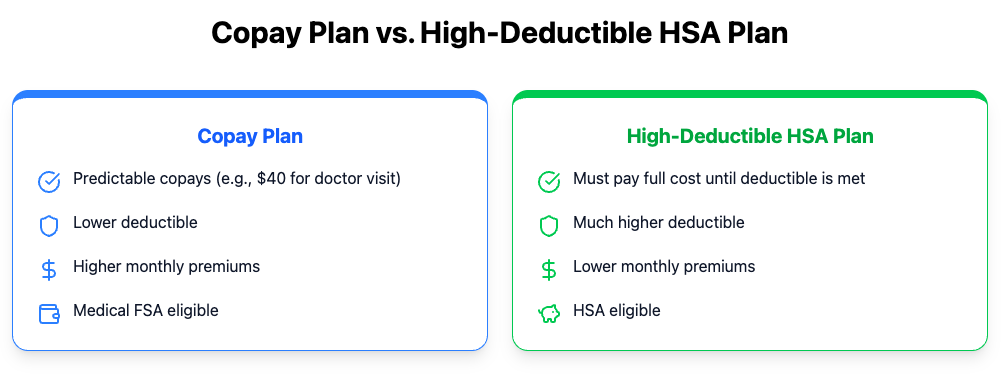

Understanding Your Options: Copay vs High-Deductible HSA Plans

Before diving into the numbers, let's clarify the fundamental differences between these benefit structures.

Copay Plans: Predictable but Limiting

- You pay a fixed amount per visit—say $40 for your primary doctor or $60 for a specialist.

- Premiums are higher than HSA plans.

- Eligible for a Flexible Spending Account (FSA). Remember: FSA = “use it or lose it” each year.

High Deductible HSA Plans: Higher Upfront Costs, Massive Long-term Benefits

- You pay the full cost of medical visits until you hit your deductible.

- Premiums are lower than copay plans.

- Eligible for a Health Savings Account (HSA). Funds roll over each year and can be invested for long-term growth.

The Real Numbers: Big Law Firm Analysis

Working with attorneys across major firms, I kept hearing the same concerns: "The numbers are too complicated," and "I don't have time to figure this out during open enrollment." That's exactly why I built a comprehensive calculator that does the heavy lifting. You can download it for free here.

Using actual benefit structures from a prominent big law firm, I modeled two scenarios for a typical attorney family of four (similar to my own situation with a 7-year-old and 4-year-old). Here's what the analysis revealed:

Breaking Down a "Normal" Medical Year

For this family, I estimated realistic healthcare usage based on my own experience:

- 5 specialist visits throughout the year

- 5 urgent care visits (kids get sick, right?)

- 1 emergency room visit

- Regular checkups and preventive care

The Copay Plan Costs:

- Annual premium: $16,284

- Out-of-pocket medical expenses: $750 (those $50 copays add up)

- Less: Tax savings on premiums and FSA contributions: $5,691

- Net cost: $11,343

The HSA Plan Costs:

- Annual premium: $9,050 (significantly lower)

- Out-of-pocket medical expenses: $5,000 (paying full cost until deductible)

- Less: Employer HSA contribution: $1,000 (free money!)

- Less: Tax savings on premiums and HSA contributions: $5,376

- Net cost: $7,674

Bottom line: $3,669 annual savings with the HSA plan, even though the family paid more out-of-pocket for individual visits.

The "Expensive Year" Reality Check

Every attorney asks: "But what if we have a really expensive medical year?" Great question. I tested this with a $10,000 major medical expense - think birth of a child, extended hospital stay, or significant procedure.

The surprising result: Even with major medical expenses, the HSA plan still came out ahead by $3,869.

Here's why: both plans hit their deductibles, but the HSA plan's lower premiums, HSA match, and tax advantages more than compensated for the higher out-of-pocket maximums.

The key insight: The financial advantages of HSA plans aren't just theoretical - they hold up even when life throws you curveballs.

This analysis represents one firm's benefit structure and individual results will vary. The real value lies in understanding how these different cost structures impact your specific situation - something that requires looking at your actual benefits package and healthcare patterns.

The Million-Dollar HSA Strategy

The real power of HSA plans isn't just the annual cost savings - it's the wealth-building potential.

30-Year HSA Projection (Starting Age 35)*

- Lifetime Employee Contributions: $337,548

- Employer Contributions: $43,555

- Projected Balance after 30 years (8% return): $1.36 million

- Tax-Free Growth: Over $1 million

*Projection assumes that contribution limits increase 2.45% annually (historical average) and investment growth of 8%.

The Triple Tax Advantage

HSAs offer unmatched tax benefits:

- Tax-deductible contributions (lowers current income taxes)

- Tax-free growth (no taxes on investment gains)

- Tax-free withdrawals (when used for qualified medical expenses)

No other account type offers this combination.

When Copay Plans Make Sense: A Real Client Example

Numbers don’t tell the whole story.

A few years ago, a client of mine was debating between the copay and high-deductible HSA plan. At the time, she was seeing a therapist twice a month due to mental health issues. Under the HSA plan, each session cost $175 until she hit her deductible. Under the copay plan, it was just $50.

After going through the analysis together, she said: “If I have to pay $175 every visit, I will literally not go.”

In her case, the copay plan was the best choice—because your health is more important than numbers in a spreadsheet.

Big Law Employee Benefits: Why This Decision Matters More

If you’re in Big Law, here’s the reality:

- Many firms offer weak benefits compared to corporate America.

- Premiums are high, deductibles are steep.

- You’re in a high tax bracket—so the tax advantages of an HSA are especially powerful.

This makes your copay vs HSA choice one of the most financially impactful decisions you’ll make during open enrollment.

Choose HSA Plans If You:

- Can handle higher upfront medical costs

- Want to maximize long-term wealth building

- Have emergency funds to cover deductibles

- Are generally healthy with predictable medical needs

Consider Copay Plans If You:

- Need frequent medical care

- Prefer predictable healthcare costs

- Would delay care due to higher out-of-pocket expenses

- Are close to retirement and won't benefit from long-term HSA growth

Frequently Asked Questions

Q: Can I contribute to both FSA and HSA?

A: No, HSA eligibility requires enrollment in a high-deductible health plan, which makes you ineligible for Health Care FSAs. But you can contribute to an HSA and a Dependent Care FSA to reimburse childcare costs if both you and your spouse work.

Q: What happens to my HSA if I change jobs?

A: HSAs are portable - the account follows you regardless of employment changes.

Q: Are there income limits for HSA contributions?

A: No, unlike IRAs, HSAs have no income restrictions for contributions.

Q: What qualifies as a medical expense for HSA withdrawals?

A: The definition is broad, including premiums, prescription drugs, medical equipment, and even some over-the-counter medications. Here's a useful publication from the IRS that discusses eligible medical expenses.

The Bottom Line

For most attorneys, especially those early in their careers, the high-deductible HSA plan offers compelling advantages. The combination of lower annual costs and massive long-term wealth-building potential makes it hard to ignore.

But remember my client's wisdom: your health comes first, the spreadsheet comes second. Choose the plan that supports both your financial goals and your healthcare needs.

The million-dollar question isn't whether HSAs are more advantageous in a spreadsheet - it's whether they're right for your specific situation.

Need Help Making a Plan?

Don’t let a single benefits election cost you a million dollars in future wealth. Schedule a call today and let’s make sure your open enrollment choices set you up for long-term success.

👉 Schedule your free introductory call

👉 Learn more about our services & pricing

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.