By Joel Chouinard, ChFC®

April 4, 2024

If you’re a partner at a law firm, I’m sure you’re well aware that you are now considered a self-employed individual in the eyes of the IRS. Being self-employed does not mean that you work alone. It simply means that you are now getting taxed as a business owner, which you are! At this point, you have likely hired someone to prepare your tax return due to the added complexity. The tax preparation services should also come with an estimate of your tax liability for the following year, broken down into four equal quarterly estimated payment vouchers. So far so good, right?!

The issue is that, as a partner, your income is all but equal throughout the year. You are likely receiving a regular paycheck, in the form of guaranteed payments, but that amount is only a fraction of your total income for the year. You are also likely receiving profit distributions, but they may be different from quarter to quarter, depending on how the firm is doing. Lastly, you may be getting a performance bonus paid out once a year, but that bonus is not guaranteed and is based on billable hours. Therefore, large quarterly tax payments mixed with an uneven income flow could put pressure on your budget. So how can partners smoothen their cash flow throughout the year and minimize the impact of quarterly taxes? Before we get into that, let’s first discuss how compensation and taxation work for law firm partners.

Understanding Law Firm Partnership Compensation

If you’re a partner at a law firm, you typically get compensated in three ways: base pay (or guaranteed payments), performance bonuses, and profit distributions. Base pay compensates you for the services you provide to the firm, such as performing legal work on behalf of the firm, and also for management and administrative duties. You may also receive a performance bonus to reward you for your hard work. Base pay should be set in advance and shouldn’t fluctuate throughout the year, whereas the bonus may be more discretionary and dependent on how many hours you billed.

The second component of law firm partner compensation is profit distributions. As an owner of the firm, you participate in the profits of the firm, pro-rata to your share of ownership. Now, that’s primarily true for small boutique firms. For large firms with many partners, the profit distribution calculation is based on a complex formula to which only a few high-ranked professionals at the firm are privy. Large law firms also typically have two levels of partnership, income partners (or nonequity partners) and equity partners, so not every partner gets a share of the profit pie.

Regardless of the sources of income you receive (base pay, bonus, or profit distributions), this income is considered self-employment income to the IRS.

Understanding Self-Employment Income Taxation

There are two main differences between being a W2 salaried employee (e.g., associates, admin staff, etc.) and being a self-employed individual (e.g., partners).

- Taxes are no longer withheld from your paychecks. It is now your responsibility to remit those taxes to the IRS via Quarterly Estimated Payments (more on that below).

- You are now subject to the self-employment tax. Without getting into too much detail (more on this topic here), in essence, the self-employment tax is the equivalent to the Medicare and Social Security tax that W2 employees and their employers must pay.

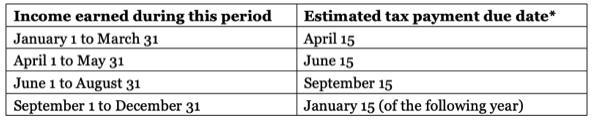

Also, it’s important to note that the IRS looks at a self-employed individual’s tax liability from quarter to quarter. This means that the tax liability for dollars earned in one quarter must be paid at the end of that quarter. You cannot simply wait until the end of the year and pay all tax liabilities. If you choose to do so, you will likely be subject to underpayment penalties. The deadlines to pay quarterly taxes are illustrated below:

Due dates for quarterly estimated taxes.

*The exact due date may vary if the due date falls on a weekend or holiday.

It’s important to note that some state taxes also require quarterly tax payments, but state taxation is outside the scope of this article.

Calculating Quarterly Estimated Tax Payments

Now that we understand partnership compensation and self-employment taxation, how do you figure out what your quarterly estimated tax payments need to be? Well, the calculation can be quite complex, so I always recommend working with a tax professional. The goal is to estimate what your total tax liability is going to be for that year and break it down into four equal payments remitted to the IRS according to the schedule above.

First, you need to factor in all income sources for that year, such as your projected income from the partnership (base pay, bonus, and profit distributions), your spouse’s income (if any), investment income, interest and dividends, rental property income, etc. Your financial planner can work with your tax preparer for that part of the equation. Next, you need to estimate your above the line and below the line deductions. Are you contributing to your 401(k) or HSA at work? Do you normally take the standard deduction or itemize your deductions? Lastly, will you be eligible for tax credits, such as the Child Tax Credit? From there, you can calculate your projected tax liability (minus any tax withholdings from other sources of income in your household) and divide that number into four equal payments. That’s your quarterly estimated tax payment.

Planning for Quarterly Tax Payments

So far, we’ve discussed quarterly estimated tax payments and how to calculate them. In reality, these payments can be quite large and planning for them can be tricky for a budget since they are not withheld from your paycheck like W2 salaried workers. Moreover, your income is not received evenly throughout the year, so without proper planning, you could find yourself not having enough funds to pay both your expenses and your tax bill.

Accumulate one quarter’s worth of estimated taxes prior to becoming partner

To the extent possible, in the months prior to becoming a partner, try to accumulate around one quarter’s worth of estimated taxes. This will ensure that you have enough funds to pay for your day-to-day expenses and make the first quarterly payment. Remember, the guaranteed payments for your services may be a fraction of the paychecks you used to receive as a W2 employee, so you have to plan accordingly. But the quarterly profit distributions will make up for the difference, and more! If you’re already a partner and are having cash flow issues, try to bulk up your savings account next time you receive a bonus.

Open a savings account earmarked for taxes

Once you start receiving your bi-weekly or monthly paychecks, I recommend taking a percentage of those paychecks, which you’ve agreed upon with your accountant, and putting it into a savings account labeled “Quarterly Taxes.” Once you receive your profit distribution at the end of the quarter, take a portion of that distribution and whatever amount you’ve accumulated in your “Quarterly Taxes” account, and make your quarterly tax payment according to what your accountant recommended. Then, you can use the rest of the profit distribution to replenish your checking account and smooth out your budget until the next distribution. Most law firms time their quarterly distributions with the quarterly tax payment schedule, so that shouldn’t be a problem.

Note about performance bonuses

If you normally get a performance bonus, you may decide to exclude it from your initial income calculation since it is not guaranteed. If you do that, make sure to pay an extra amount of taxes in the quarter that you receive it. Otherwise, you’ll likely have a shortfall at the end of the year.

Final Note

Becoming a partner and the idea of being “self-employed” can be scary, I admit. You’ve probably heard some of your co-workers tell you that they felt like they made less money as a junior partner than as a senior associate. The reality is, if you surround yourself with the right team, it should not be any more work on your end, and you should feel good about the earnings potential of your new position and your career trajectory.

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.