By Joel Chouinard, CFP®

January 7th, 2025

A recent study from the Motley Fool shows that 69% of Americans plan on making a financial New Year’s resolution for 2025*. Yet, a 2024 study from Schwab shows that only 36% of U.S. adults have a written financial plan**. Why is that? My guess is that we are very good at setting goals but not so good at seeing them through. There are a few factors for why that’s the case. For one, there are many components in a financial plan (e.g., cash flow, debt, investments, taxes, estate planning, etc.), and most people lack the basic knowledge to address these issues (or simply don’t know what to prioritize). Also, humans typically choose instant gratification over delayed gratification. Well, most financial goals are delayed gratification, so it’s hard to plan for something that may not happen for many years into the future. This article discusses a four-step process to creating financial goals that will stick so you can take charge of your finances in 2025.

Step 1: Create a List of Your Goals

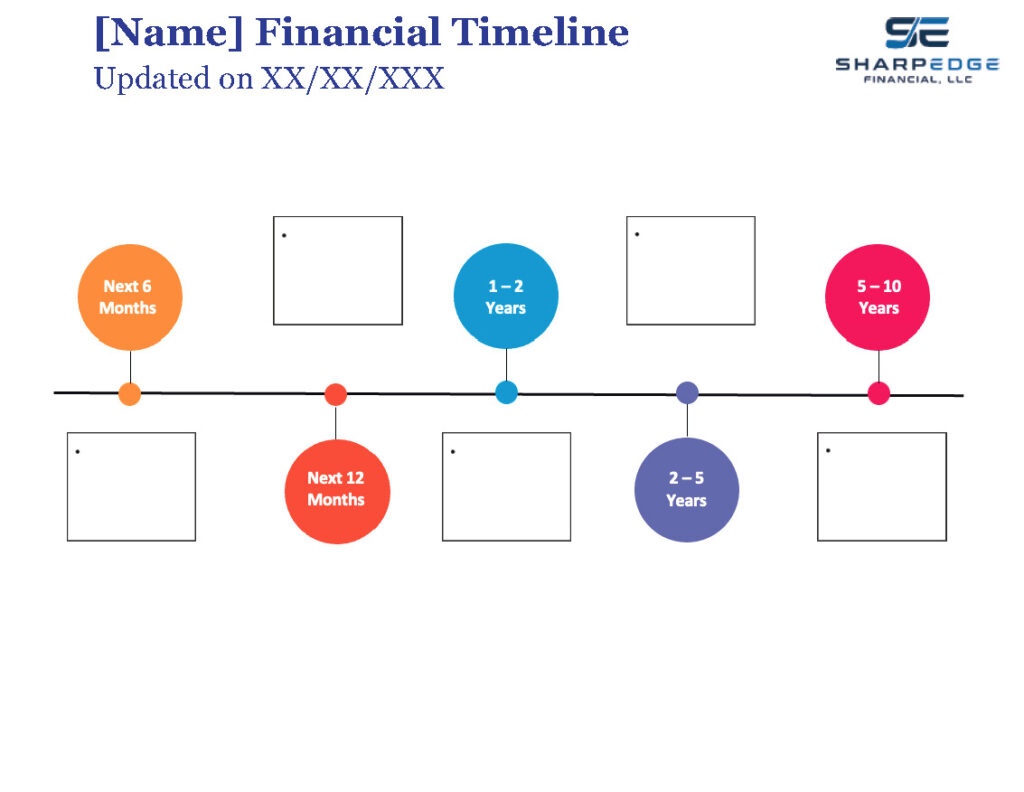

The first step in setting financial goals that stick is to create a list of goals that you want to accomplish over the next several years (ideally over the next ten years). Some goals may require many years of planning/savings, so that’s why you want to think beyond just one year. If you have difficulty picturing yourself that far ahead, I encourage you to create a timeline of what your life could look like over the next ten years (see Image 1.0 bel0w). This will also help create a sense of urgency for some of your longer-term goals. For example, if you’d like to leave big law in the next few years, there are things you can do now to help with the transition (e.g., create a transition fund or pay off your student loans). You can download the timeline below using this link.

Image 1.0

Image 1.0

Wants vs. Needs

I recommend that you break down your goals into two categories: your wants and your needs. Your wants are the fun things you desire to do. Maybe it’s a trip to Europe or maybe it’s renovating your kitchen. Whatever it is, don’t worry about how you’re going to fund it yet, just write it down. We will prioritize your goals in step 2. Next, you want to write down your needs, or in other words, the core components of your financial plan that haven’t been addressed. Maybe it’s creating your estate plan or maybe it’s getting your emergency fund to a comfortable level. If you don’t know which component you’re missing, don’t worry, we will address this in step 2 as well.

Step 2: Prioritize Your Goals

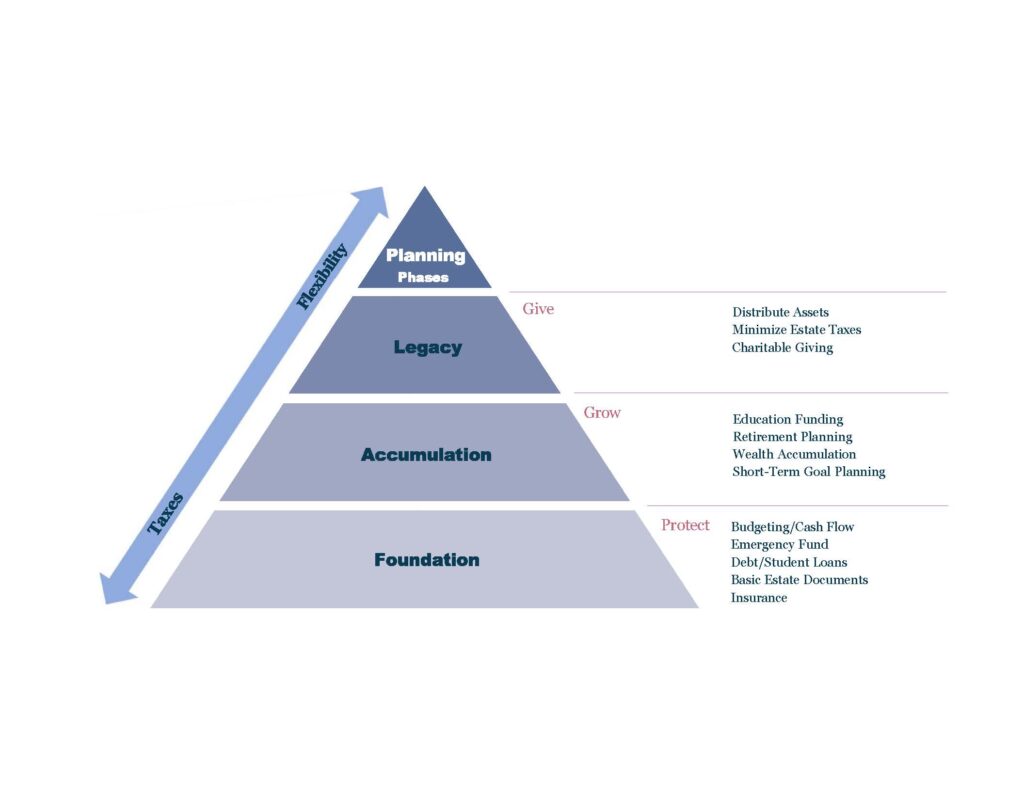

Now that you have your list of goals, it’s time to prioritize. It would be human nature to prioritize the fun goals and ignore the rest, but I encourage you to strike a balance between your needs and wants. One way to do this is to use the Financial Needs Pyramid (see Image 2.0 below). The Financial Needs Pyramid breaks down the core components of your financial plan into three buckets (Foundation, Accumulation, and Legacy) and ranks them in order of importance.

Image 2.0

The theory is that you should prioritize foundational items first before you move on to the accumulation phase. And you should only focus on legacy planning once you’ve accumulated enough wealth to support your lifestyle. For example, you should pay off high-interest credit card debt (foundational planning) before worrying about charitable giving (legacy planning). That said, just like everything in life, the process of prioritizing your goals is not black and white. To use the example above, if you have credit card debt, but your company offers a 401(k) match, take advantage of it. It’s free money! And I’m certainly not suggesting that you stop donating money in the collection plate at church until you are financially independent. Rather, you should use the pyramid as a guide to help prioritize your goals.

So take your list of goals (or timeline), and reorganize them in order of priority using the Financial Needs Pyramid. You may also add new goals after looking at the Financial Needs Pyramid.

Step 3: Create Your Action Plan for This Quarter

At this point, you should have prioritized your goals, so now it’s time to start planning how you can achieve them. The key to success here is to break down your plan into bite-size pieces. From your list, select one to three goals that you would like to tackle for this quarter, and create a list of action items that will help you get there. Try to be as specific as possible with your action items. For example, if your goal is to have a fully funded emergency fund by the end of the year, don’t just write down “create an emergency fund.” Rather, your action items for this quarter should look something like this:

- Determine emergency fund needs.

- Determine savings needed to achieve goal.

- Open High-Yield Savings Account.

- Create automatic transfers between checking and emergency fund.

If you don’t know what steps are needed to accomplish each goal, there are tons of free resources online for pretty much every personal finance topic. If you don’t want to do the research, reach out to a financial planner, so they can do it for you!

Step 4: Review Your Progress Each Quarter

The goal of breaking down your plan into small, actionable items is to avoid getting overwhelmed and ultimately, accomplishing nothing. At the end of each quarter, take a few minutes to look at your action plan and see if there are any steps still outstanding. If there are, it’s okay! Just add them to next quarter’s list of action items. From there, take out the goal list (or timeline) that you created in steps 1 and 2, and again, pull one or two items from that list. Create new action items for this quarter and get to work! If you continue doing this quarter after quarter, you’ll be shocked at how much you can accomplish in one year!

Final Note

Whether it’s time or money, our resources are finite. On the one hand, you will need to allocate your dollars toward the things that are most important to you. On the other hand, you will need to decide whether you want to spend the time to learn about all the different components of a financial plan or outsource these tasks to a qualified financial planner.

Sources

*https://www.fool.com/money/research/financial-new-years-resolutions/#:~:text=Among%20respondents%2C%2082%25%20of%20millennials,Financial%20New%20Year's%20Resolution%20survey.

** https://pressroom.aboutschwab.com/press-releases/press-release/2024/2024-Schwab-Modern-Wealth-Survey-Shows-Increasing-Financial-Confidence-From-Generation-to-Generation-and-Younger-Americans-Investing-at-an-Earlier-Age/default.aspx

SharpEdge Financial LLC is a registered investment adviser registered with the State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment. The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.